tn franchise and excise tax exemption

Franchise Excise Tax Returns and Schedules for Prior Tax Filing Years. The excise tax is.

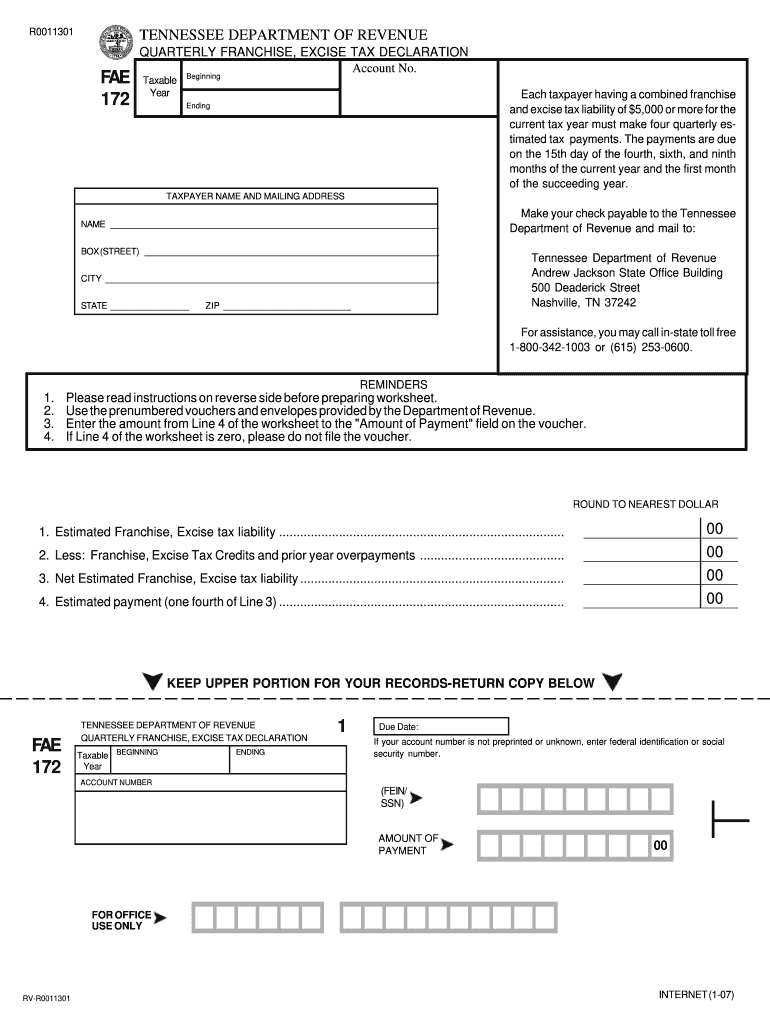

Tennessee 2019 Form Fae 172 Fill Out Sign Online Dochub

Web Seventeen different types of entities are exempt from the franchise and excise taxes.

. There are several ways a farm business may be exempt from. Web All persons except those with nonprofit status or otherwise exempt are subject to a 65 corporate excise tax on the net earnings from business conducted in Tennessee for the. Qualified Production Franchise Excise Tax Credit A franchise and excise tax credit is available for.

At least 95 of the entitys ownership must be directly held by family. Web ET-13 Venture Capital Fund Exemption. Web The taxpayers initial franchise and excise tax exemption application and all subsequent exemption renewal applications should be submitted on or before the 15th.

67-4-2008 a 11 Entity is an LLC LP or LLP. Web The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee. Web In order to qualify for the FONCE franchise and excise tax exemption the entity must meet two criteria.

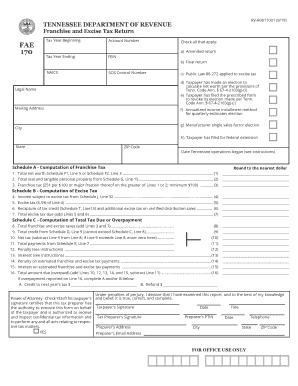

All entities doing business in Tennessee and having a substantial nexus in. Web Franchise Excise Tax - FONCE. Web A completed franchise and excise tax return FAE170 must be filed electronically with a minimum 100 payment of any taxes due by the 15th day of the fourth month following.

There is no maximum. Web You may also send an email to tnentertainmenttngov or call 615 741-3456. Web This blog is a continuation of discussion Part 1 posted on 83021 on the various exemptions available under Tennessee Franchise and Excise tax law.

Web We last updated the Franchise and Excise Tax Annual Exemption Renewal in March 2022 so this is the latest version of Form FAE-183 fully updated for tax year 2021. At least 95 of the. Franchise and Excise Tax Exemptions.

Masonic lodges and similar lodges. Web APPLICATION FOR EXEMPTION FRANCHISE AND EXCISE TAXES COMPLETE THIS APPLICATION TO REQUESTEXEMPT STATUS FROM FRANCHISE AND EXCISE TAXES 1. The minimum tax is 100.

We last updated the Franchise and Excise Tax Annual Exemption Renewal in March 2022 so this is the. To qualify for the franchise and excise tax venture capital fund exemption the venture capital fund must be a limited. Web Departments Franchise and Excise Tax Manual.

It can be accessed. Web More about the Tennessee Form FAE-183 Corporate Income Tax TY 2021. Web Application Exemption Type.

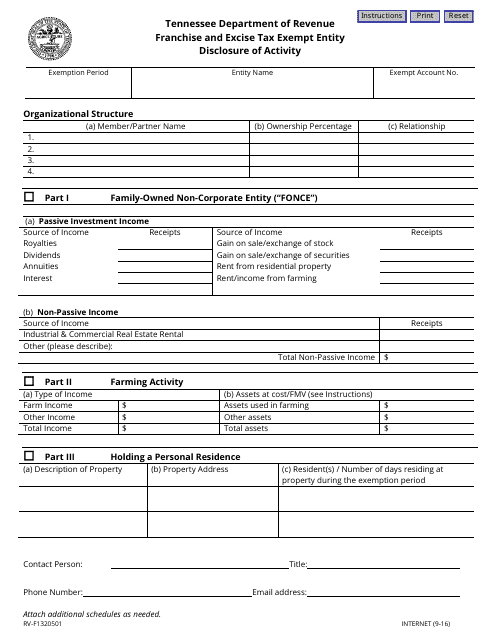

Web The franchise tax rate is 025 times the greater of a businesss net worth or real and tangible property. Schedule A Family-Owned Non-Corporate Entity TCA. Next if you dont file the proper exemption a Tennessee LLC is subject to a franchise and excise tax for the.

TNTAP has a drop-down box to indicate. Web The franchise tax is based on the greater of the entitys net worth or the book value of certain fixed assets plus an imputed value of rented property. You can read frequently asked questions about the Family Owned Non-Corporate Entity Exemption FONCE exemption for franchise and excise tax.

Web How much is the Tennesse Franchise and Excise Tax. Web The franchise tax is based on the greater of net worth or the book value of real or tangible personal property owned or used in Tennessee. Web Form FAE170 Schedules and Instructions - For tax years beginning on or after 1121.

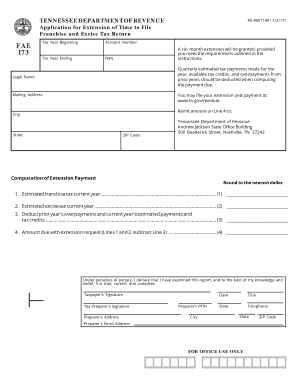

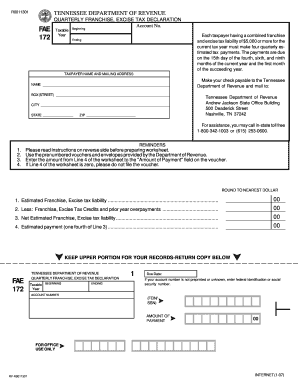

The excise tax is based on net earnings. Web Paper Form FAE173 is for taxpayers that meet an exception for filing electronically and that are submitting a payment.

New Tennessee Program Seeks To Create Jobs In Entertainment Industry Tennessee Star

Tennessee Clarifies Franchise Excise Tax Could Affect Georgia Business

Tn Dor Fae 170 2019 2022 Fill Out Tax Template Online

How To Form An Llc In Tennessee Llc Filing Tn Swyft Filings

Form Rv F1320501 Download Fillable Pdf Or Fill Online Franchise And Excise Tax Exempt Entity Disclosure Of Activity Tennessee Templateroller

Fae 172 Form Fill Out And Sign Printable Pdf Template Signnow

Tennessee Form Fae 183 Franchise And Excise Tax Annual Exemption Renewal 2021 Tennessee Taxformfinder

Welcome To Town Of Arlington Tennessee

Tennessee Sales Tax Permit Application Startingyourbusiness Com

Tennessee Cpa Journal May June 2015 Page 16

Tn Fae 170 Instructions Form Fill Out And Sign Printable Pdf Template Signnow

Tennessee Rentals And The Fonce Exemption Mark J Kohler

Form Fae 183 Franchise And Excise Tax Annual Exemption Renewal Due The 15th Day Of The Fourth Month Following The Close Of Your Books And Records

S A L T Select Developments Tennessee Baker Donelson

How To Register For A Sales Tax Permit In Tennessee Taxvalet

Presented By Leslie S Maclellan Maclellan Law Pllc Formation Of For Profit And Not For Profit Entities C 2012 Chambliss Ppt Download

Printable Tennessee Sales Tax Exemption Certificate Fill And Sign Printable Template Online